Visibility Alone Does Not Deliver Savings

Many organizations deploy cost dashboards only to find savings stagnate. Raw visibility surfaces problems but does not prescribe solutions. CoreFinOps bridges the gap by enriching AWS Cost and Usage Reports with context, analytics, and automation. The platform breaks down the journey from data ingestion to actionable savings, ensuring insights translate into measurable outcomes.

This approach recognizes FinOps as an operational discipline, not a reporting exercise. Every dashboard panel is backed by recommended steps, stakeholders, and expected ROI.

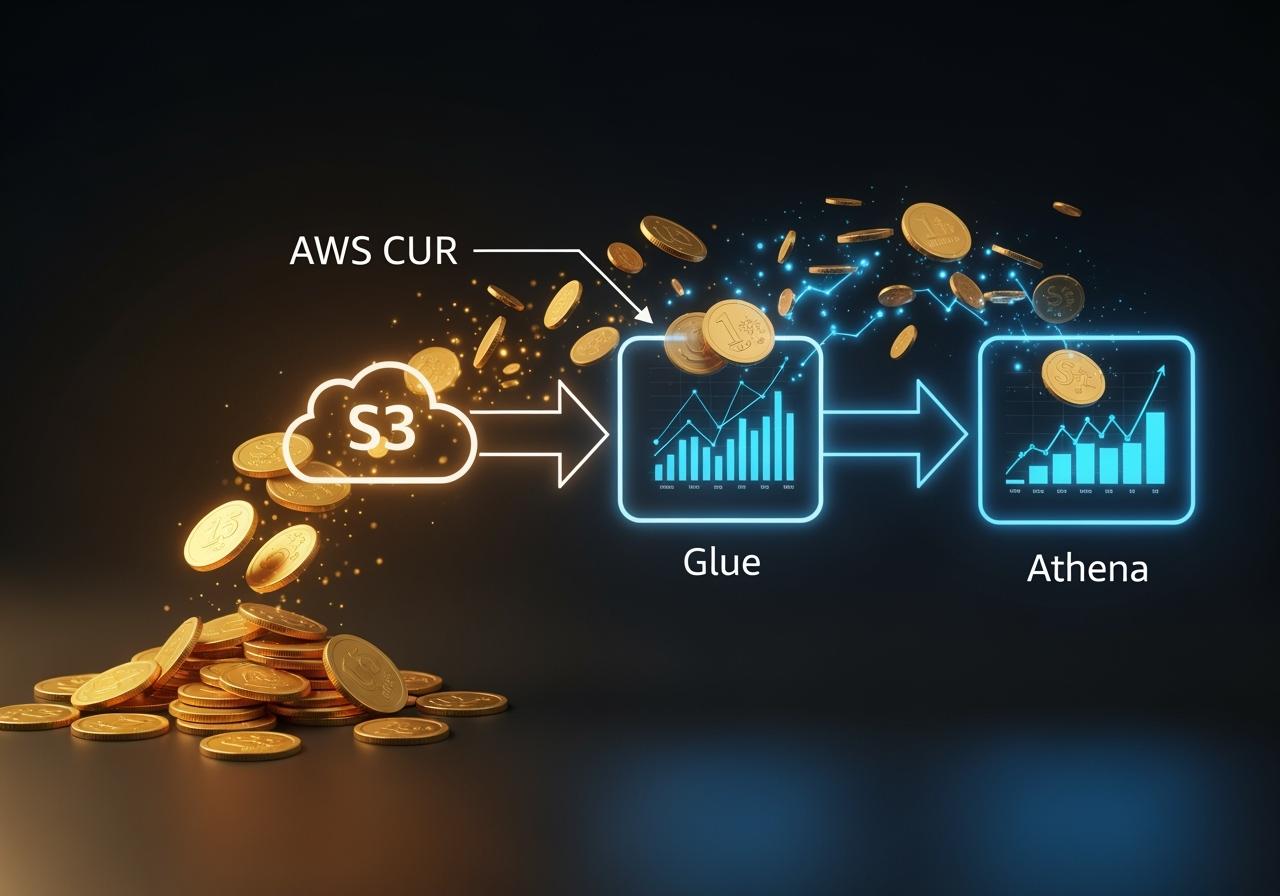

CUR→Glue→Athena: A Managed Analytics Pipeline

CoreFinOps automates the ingest of CUR exports into Amazon S3, partitions data by payer and linked accounts, and applies Glue crawlers to maintain schema. From there, Athena queries power dashboards, anomaly detection, and forecast models. The pipeline handles data normalization: currency conversion, blended vs. unblended cost harmonization, and tag standardization. Customers no longer wrestle with manual ETL jobs or brittle SQL scripts.

Data freshness is near real-time. Incremental updates run multiple times per day, and CoreFinOps monitors for CUR delivery issues, alerting teams when AWS reports lag. This reliability keeps FinOps insights aligned with the latest spend activity.

Findings + Recommendations Model

Central to CoreFinOps is the Findings + Recommendations model. Findings represent observed conditions-idle instances, rising storage costs, underutilized commitments. Recommendations pair those findings with remediation options ranked by savings potential and implementation effort. Each recommendation includes supporting evidence, impacted teams, and automation links.

This model transforms dashboards into to-do lists. Instead of asking “What do we do about this spike?” teams receive clear guidance: pause these instances, adjust S3 lifecycle rules, or optimize Lambda memory. The platform even estimates potential savings and timeline, boosting confidence in action.

Prioritizing Impact with Intelligent Scoring

Not all opportunities are equal. CoreFinOps scores recommendations based on savings magnitude, risk, effort, and alignment with business goals. A high-impact rightsizing opportunity surfaces ahead of a minor tagging fix. Leaders filter by strategic themes-cost avoidance, margin improvement, sustainability-and assign ownership quickly. This prioritization prevents teams from drowning in low-value tasks.

Scores update as new data arrives. If usage shifts or the opportunity is partially addressed, the recommendation re-evaluates automatically. The FinOps backlog stays current without manual grooming.

Dashboards That Drive Decisions

Dashboards in CoreFinOps are decision dashboards, not static charts. Each widget links to findings, recommendations, and playbooks. Cost allocation views tie spend to business capabilities, while product lenses show unit economics trends. Executives see summarized KPIs with drill-through access to evidence. Engineering squads receive workload-centric dashboards highlighting their top opportunities.

Embedded narratives explain what changed and why it matters. The combination of data and storytelling accelerates alignment across finance, engineering, and leadership.

Automation Playbooks Execute and Track

Once teams choose an action, CoreFinOps offers automation playbooks-scripts, Step Functions workflows, or integrations with Terraform and CloudFormation. Users can launch automations directly or export implementation guides. Each action logs to the ROI ledger, capturing approval details and realized impact. Post-action analytics verify that savings materialized, feeding back into the recommendation engine to refine future guidance.

If manual intervention is required, tasks sync with Jira, Asana, or ServiceNow, complete with evidence attachments. FinOps stays embedded in existing delivery workflows.

Continuous Improvement Through Feedback Loops

CoreFinOps learns from every action. When teams mark a recommendation as completed, deferred, or rejected, the platform captures reasoning. Machine learning models incorporate this feedback to tailor future suggestions. If a team routinely declines storage tier changes due to performance needs, the engine adjusts thresholds or offers alternatives.

This loop turns the platform into a trusted advisor rather than a noisy alert system. Over time, insights align perfectly with organizational priorities, ensuring the effort spent on FinOps delivers outsized returns.

Wrapping up

Visibility is a necessary foundation, but action is the goal. CoreFinOps connects the dots from raw AWS data to prioritized recommendations and automation, ensuring every insight leads to measurable savings.

With managed pipelines and intelligent models doing the heavy lifting, your teams can focus on executing optimizations that move the business forward.