Why SMBs Choose CoreFinOps for Cloud Cost Control

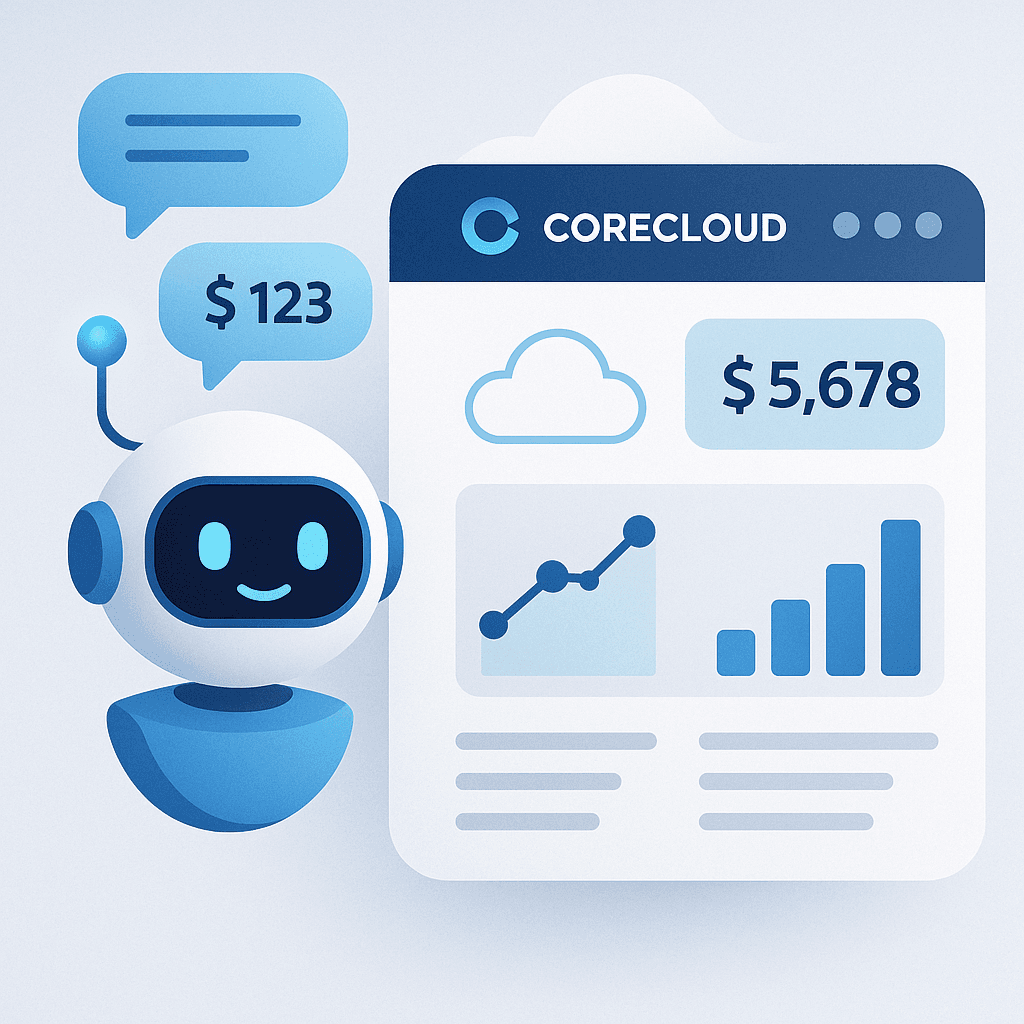

SMBs need FinOps speed without complexity. See how CoreFinOps delivers guided onboarding, low idle cost, intuitive dashboards, and Slack-ready alerts tailored to growing teams.

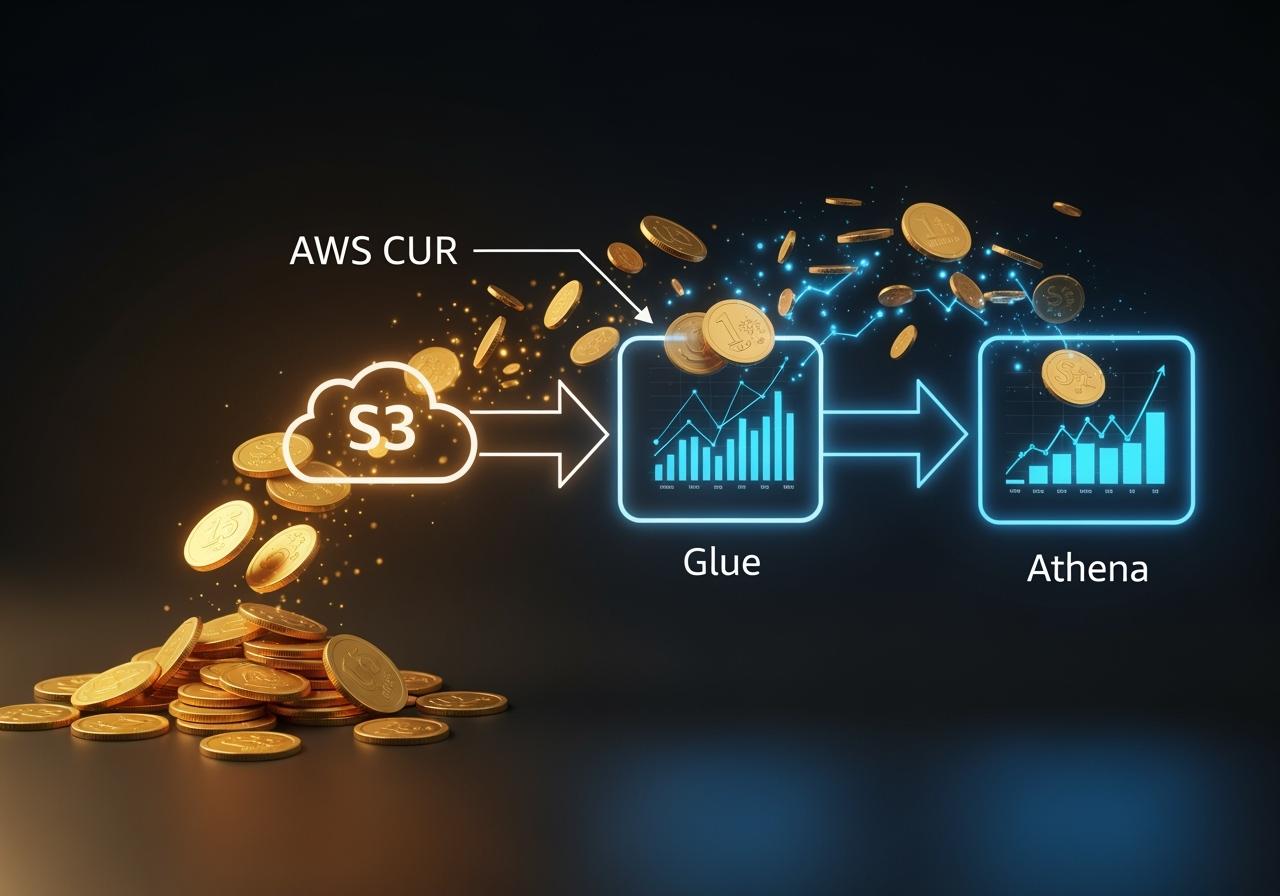

- Guided onboarding connects billing data and dashboards in hours, not weeks.

- Low idle cost automation keeps spend predictable for lean teams.

- Intuitive dashboards translate AWS data into business-ready narratives.